The recent imposition of tariffs on automotive parts and vehicles has raised concerns about their potential impact on various sectors, including auto insurance. While the direct connection between tariffs and auto insurance might not be immediately obvious, the ripple effects could be significant.

Increased Repair Costs

One of the most immediate effects of tariffs is the increase in the cost of imported auto parts. Many car parts are sourced from international suppliers, and tariffs can drive up the prices of these components. As a result, the cost of repairing vehicles could rise, leading to higher claims costs for insurance companies. Insurers may then pass these increased costs on to consumers in the form of higher premiums.

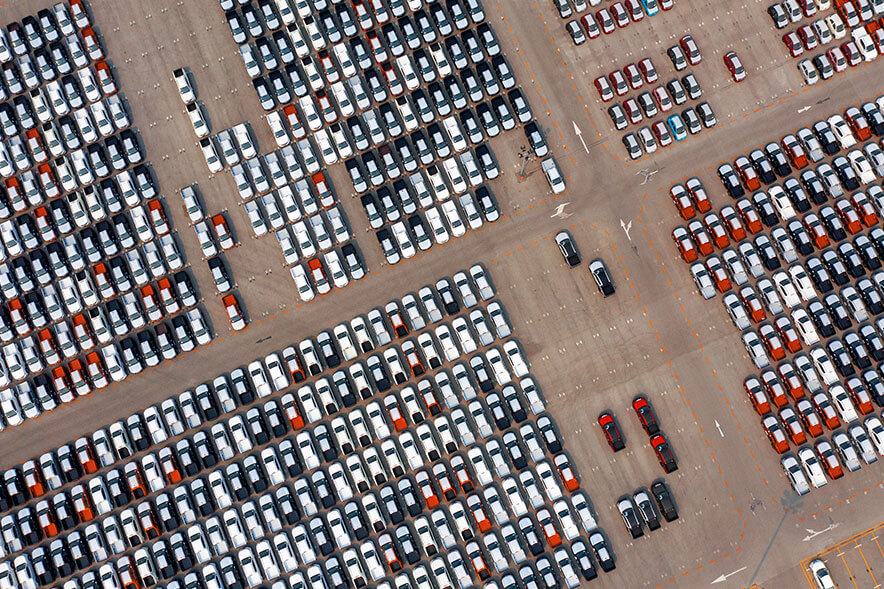

Higher Vehicle Replacement Costs

Tariffs can also affect the prices of new and used vehicles. If the cost of importing vehicles or parts increases, the overall price of vehicles may rise. This means that in the event of a total loss claim, insurance companies might have to pay out more to replace the vehicle, potentially leading to higher premiums for policyholders.

Supply Chain Disruptions

Tariffs can disrupt supply chains, causing delays in the availability of parts and services. This can lead to longer repair times and increased costs for temporary housing or rental cars while vehicles are being repaired. These additional costs can also contribute to higher insurance premiums.

Inflation and Economic Impact

Tariffs can contribute to overall inflation, which can affect the cost of living and, consequently, the cost of insurance. As the prices of goods and services rise, insurers may need to adjust their premium rates to keep up with the increased costs.

Final Thoughts

While the direct impact of tariffs on auto insurance might not be immediately apparent, the indirect effects through increased repair and replacement costs, supply chain disruptions, and inflation can lead to higher premiums for consumers. As the situation continues to evolve, it will be important for policyholders to stay informed and consider reviewing their coverage to ensure it meets their needs in a changing economic landscape.

Explore a wealth of insights and valuable information on our blog. Connect with us online, follow our updates on Facebook, Instagram or, give us a call to get started.