If you’ve been hearing about parametric insurance but are unsure how it works—or whether it’s the right choice for you—this post will cover the essentials.

Is Parametric Home Insurance a New Trend?

Yes, parametric insurance is a recent innovation in the Canadian market, including in Ontario. While it has been available in other industries (like agriculture or natural disaster risk management) for a few years, it’s only now becoming more widely available to homeowners as insurers respond to the rising number of natural disasters and the challenges of traditional claims processes.

How Does Parametric Home Insurance Work?

Unlike traditional home insurance, which requires homeowners to file a claim and prove damage, parametric insurance is based on a pre-set trigger event. This means the insurance payout is automatic if specific conditions are met—no need to prove damage or wait for an adjuster.

Here’s how parametric home insurance works step-by-step:

You choose a payout amount. You don’t insure the entire value of your home, but instead select a fixed payout (e.g., $5,000 or $10,000) that will be paid if a specific event occurs.

A trigger event happens.

When a natural disaster occurs—such as a flood, earthquake, or windstorm—official data from a trusted third party (like a weather service) will confirm whether the event met the policy’s trigger.

Automatic payout. If the event meets the agreed-upon conditions, the payout is automatically triggered, and you receive funds immediately, without needing to file a traditional claim.

Use the money however you want. Unlike traditional insurance, you’re not restricted to using the money only for home repairs. You can use it for temporary accommodation, emergency expenses, or however you see fit.

Why is Parametric Insurance Gaining Popularity in Ontario?

There are several reasons why parametric home insurance is becoming a hot trend among homeowners and insurers alike:

Faster Payouts:

Traditional claims processes can take weeks or even months. Parametric insurance ensures you get paid within days of a qualifying event, providing you with financial relief quickly after a disaster.

No Proof of Damage Needed:

There’s no need for an insurance adjuster to inspect the damage or negotiate the payout. As long as the trigger event (like a specific wind speed or flood level) happens, you’re automatically paid.

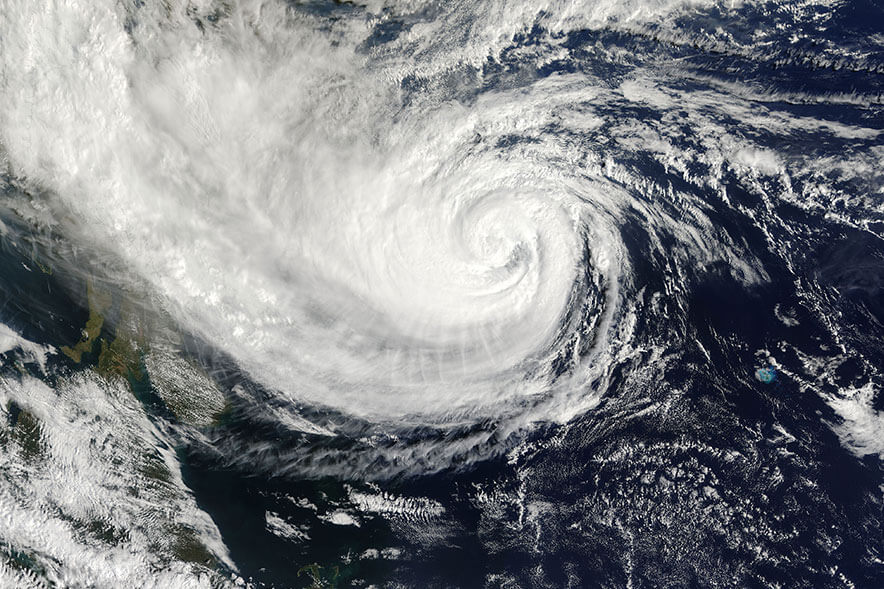

Climate Change & Extreme Weather:

With more frequent and severe weather events affecting Ontario, including floods, wildfires, and severe storms, homeowners are looking for faster, simpler solutions to protect themselves from financial loss. Parametric insurance helps fill this gap.

Fills Coverage Gaps:

Traditional home insurance policies may not fully cover damage from certain natural disasters, or the claims process can be long and cumbersome. Parametric insurance acts as additional protection, offering peace of mind and financial flexibility when it’s most needed.

Who Should Consider Parametric Home Insurance?

Parametric insurance is ideal for homeowners in Ontario who are looking for:

- Fast payouts after natural disasters

- Simpler claims processes without the need to provide damage evidence

- Extra financial protection in high-risk areas, such as regions prone to flooding, severe storms, or wildfires

- A way to cover temporary living expenses or immediate needs after a disaster, beyond just home repairs

Is Parametric Insurance Right for You?

If you live in an area that’s vulnerable to floods, earthquakes, or severe weather, parametric insurance may provide essential financial relief when you need it most. While it doesn’t replace traditional home insurance, it can act as a valuable supplement to help cover unexpected costs without the delays of standard claims processes.

Key Takeaways:

Parametric home insurance is a new, innovative insurance product that pays out automatically after a pre-determined trigger event, such as a flood or storm. It offers faster payouts and less paperwork than traditional home insurance, making it a popular choice in areas with high natural disaster risk.

This type of insurance is becoming more widely available in Ontario as homeowners seek better protection from climate change-driven events.

Contact us today for more details.