Being a high-risk business means that your industry may be unstable, your job may include some safety risks (liability), or the area that your business is located comes with is high risk.

Prior to the COVID-19 pandemic, 82% of businesses declared that health-related risks were not considered a risk to their business. In 2019, the Global Risk Management Survey ranked “pandemic” near the bottom of the list; 60 of 69. This suggests that those 82% of businesses are uninsured for the loss of profit because of the pandemic.

What is a High-Risk Business?

A high-risk business can include essential businesses that must stay open, but is a potentially dangerous place to be. This can include hospitals, clinics, dental offices, etc. These places have little to no risk of shutting down, due to their industry, but pose a risk given the nature of their business. At a dental office, patients must remove their masks, and the hygienists and dentists are tasked with operating within the patient’s mouth. At clinics and hospitals, while they must take precautions, there are groups of people presenting various symptoms. COVID can present itself in many ways.

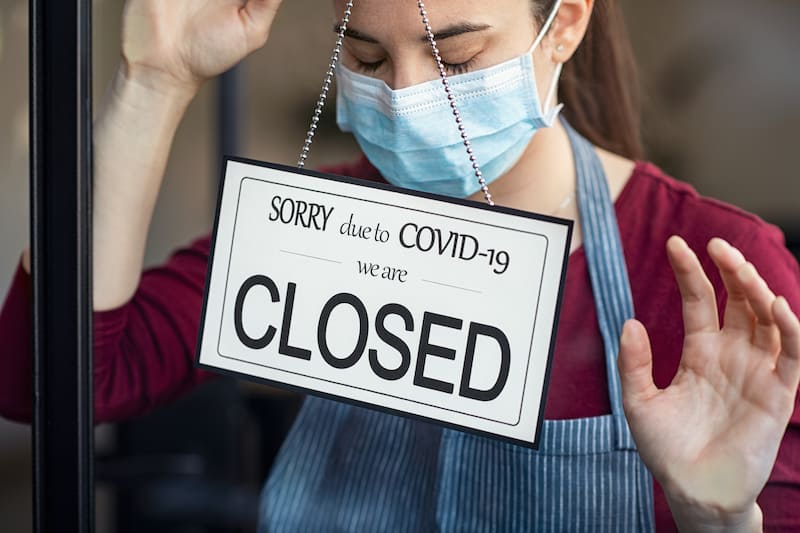

During the COVID-19 pandemic, all brick and mortar businesses whose employees cannot work remotely, are considered high risk. They are high risk because they cannot operate their businesses and continue to generate profits. These businesses are at risk of permanently closing or losing their business insurance.

Businesses that are classified as “high-risk” will often be turned away by insurance companies. Many businesses are struggling with the repercussions of the procedural cycles and periodic lockdowns. Businesses that have shut down due to government regulations are demanding that their insurance providers compensate them for lost revenue. Many court cases, where businesses sue their insurance companies for compensation, have ruled in the favour of the insurance brokers. Businesses have been losing their insurance and are having a hard time finding insurance companies to cover them.

Businesses Losing Insurance During Pandemic

Businesses have not been getting insurance compensation because many policies only cover revenue loss resulting from property damage. The virus does not cause property damage. The virus does not fall into the typical “threats” category that lists the occurrences that the insurance covers.

Due to the pandemic many businesses are now considered high-risk. This means that finding an insurance company that will provide coverage is not easy. High-risk business insurance poses a risk to the insurance provider themselves.

Always read the policy thoroughly; fine print!

For small businesses, there may be a provision in the policy that covers claims issued due to interruptions caused by civil authority; government mandated shut down. Many insurance companies do not prioritize their clients’ best interests and avoid paying insurance claims through fine print loopholes. For example, insurance companies will only pay the “civil authorities” peril if “the virus affected members of staff”.

Why AiA for a High-Risk Business?

If you are a client of AiA Insurance brokers, you can call and ask questions about your policy. At AiA Insurance, clients are not just numbers. Their clients’ are a priority. The team understands that small businesses are individuals’ sole source of income, their lifelines. The team at AiA Insurance will create custom policies to suit small business needs!

Insurance companies play a pivotal role in contributing to and supporting the economy. They are needed to support large and small businesses alike, which keep the economy going.

Insurance companies play a pivotal role in contributing to and supporting the economy. They are needed to support large and small businesses alike, which keep the economy going.

At AiA Insurance, we provide high-risk businesses with the insurance coverage they need because it is our role to support businesses.