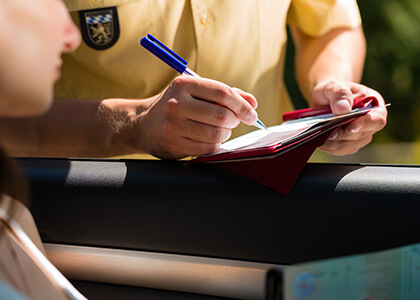

Auto Insurance news about distracted Canadian drivers. Being tempted to use a phone in the car can be pretty natural. There are emails to check, social notifications that pop up as you drive, and music/apps to check as you drive. As soon as you wake your phone up and activate one of these apps, you are committing a distracted driving offense, however. Anything that takes your attention from the road could lead to terrible consequences.

Ontario setting an example in Auto Insurance News

Luckily, Ontario is setting a great example regarding distracted driving offenses. According to Rates.ca, Ontario is the third lowest-ranking province in its latest survey of driving infractions. 85% of the people surveyed admitted to checking their phone while driving, with 16% of those responders using their phone to make a quick call, 11% texting, and the rest using apps, videos, or creating content while driving.

A distracted driving charge could result in up to a 23% increase in your auto insurance premium in Ontario.

This is a significant enough punishment that stops many drivers from attempting it.

Drivers in Canada are concerned about distracted driving all the same, with 58% of the people surveyed ranking distracted driving at the top of risks on the road.

Inattentive driving charges are rising in Ontario, even with fewer drivers engaging in it than in other provinces. Deaths attributed to distracted driving are up by 29% from 2020-2021, with drug and alcohol-related deaths declining by up to 46% in the same time frame.

Based on the survey data, many Canadians take part in short check-ins with their phones. These minor distracted driving incidents often involve checking their phone at long red lights or stop signs or quickly checking in on social media alerts like Tik Toks or Snapchats.

Distracted driving is unsafe, and there is no safe time to check an alert. Keep your full attention behind the wheel, and you can protect yourself and other drivers on the road and ensure that you don’t see a significant hike in your insurance rates.